She also has experience selling supplement coverage such as umbrella insurance. Even if you already have a home insurance policy in place, you might consider shopping around on occasion to make sure you're getting the coverage and customer service you need at the best price. This means your coverage, rates, and claims experience will depend on which company it places you with. Because of this, Progressive may not be the best choice for homeowners who prefer paying their bills and filing claims all with one company. Progressive is ideal if you’re looking to purchase home and auto insurance policies at the same time to score discounts on your premiums.

Earthquake Insurance: A Complete Guide for Homeowners (

For $350,000 in dwelling coverage, Erie offers budget-friendly home insurance that’s about 25% cheaper than the national average. You’ll pay $1,256 annually for a policy on average, a savings of $422 per year. This super-regional insurer offers several tiers of homeowners insurance in 19 states. It has basic coverage that helps after significant emergencies, such as fire or theft, and premier coverage that helps with repairs for things like countertop burns and spilled paint. It also offers combination coverage that includes basic coverage on your belongings and premier coverage on your home itself.

Best homeowners insurance in California April 2024

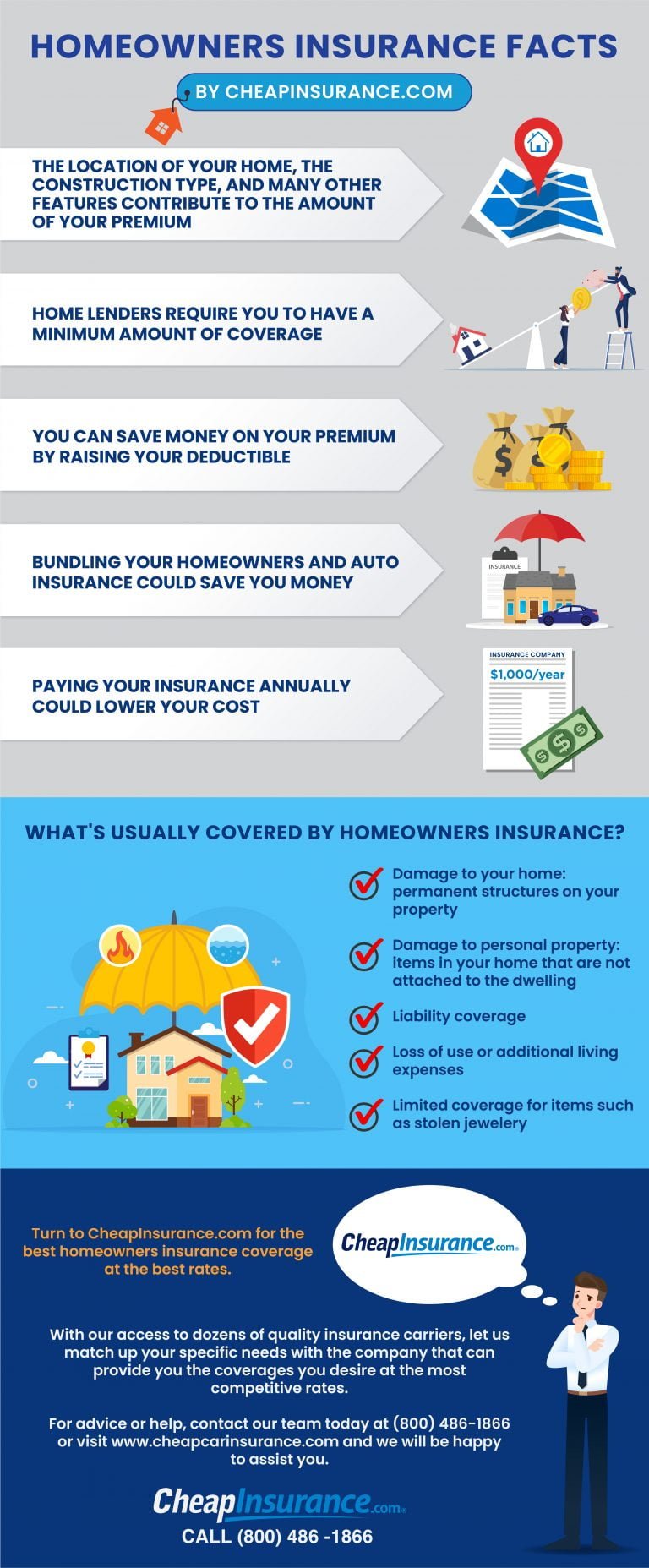

Calculating current replacement cost is a complex process, so it's a good idea to work with your insurance agent to determine appropriate coverage levels for your policy. Replacement cost policies pay to replace your lost or damaged items at home with the exact same materials. You may also not be able to get a replacement cost policy if you have an older home, because replacing such materials may be impossible. For most people, their home is their largest asset, and replacing it on their own would be nearly impossible. Home insurance coverage protects homeowners from the financial risk of loss or damage to their home in the event of a natural disaster, fire, or other hazards. We do receive compensation when a sale or referral occurs from many of the insurance providers and marketing partners on our site.

Compare Homeowners Insurance Quotes FAQ

Hopefully, you never need to file a home insurance claim, but if disaster strikes, you’ll want to know that insurance will be there for you when you need it. As such, experts recommend choosing a company that has a strong financial history, high rates of customer satisfaction and robust coverage offerings. The state you live in may also determine what perils are excluded from standard home insurance policies.

Shelter Insurance: Best for discounts

To help you compare the best home insurance quotes from Policygenius, our team of home insurance experts gave each of the largest home insurance companies in the U.S. by market share a Policygenius rating. The best way to lower your home insurance costs is to compare quotes among insurance companies. Not all insurers price their policies the same, so make sure you get quotes from multiple insurers so you can see a range of prices. You might find that other insurance companies are able to offer you better rates.

She has a Bachelor of Arts in English and has written over 800 articles about insurance throughout her career. Find answers to your insurance questions, insights into current trends, and tools for navigating life in our resource center. They did most [of] the heavy lifting and made everything super easy. Roughly 64% of young homeowners expect to move due to climate change in the next 30 years. Here's a rundown of what each coverage does and how much of each one you generally need.

Best Home Appliance Insurance Companies (April 2024) - MarketWatch

Best Home Appliance Insurance Companies (April .

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

Amica offers a program called Contractor Connection, which helps pair customers with licensed and insured contractors. Kara McGinley is deputy editor of insurance at USA TODAY Blueprint and a licensed home insurance expert. Previously, she was a senior editor at Policygenius, where she specialized in homeowners and renters insurance. Her work and insights have been featured in MSN, Lifehacker, Kiplinger, PropertyCasualty360 and more. Keep in mind, however, that removing your auto insurance from the bundle could cause you to lose the discount. Founded in 1945, Shelter Insurance is dedicated to helping protect the place you call home.

Best Cheap Renters Insurance in California of April 2024 - MarketWatch

Best Cheap Renters Insurance in California of April 2024.

Posted: Wed, 24 Apr 2024 07:00:00 GMT [source]

The amount of coverage you select will be a major factor in determining your home insurance costs. Considering your financial investment in your home and all of your belongings within it, you don’t want to skimp on coverage. Having adequate coverage is crucial in case of total destruction such as a fire or tornado.

From the sample quotes we got, both single-family HO-3 policies and condo policies offered competitive pricing. Our State Farm HO-3 quote was bundled with two cars and an umbrella policy, and the homeowners portion was just $60.08 monthly. Other discounts are available if you pay upfront or on time, including a 5% discount for setting up automatic payments. You can score additional savings of up to 10% when confirming renewal a week or more before your policy expires.

In most states, you can get a smart device called Ting that plugs into an outlet and monitors your home’s electrical system. In select states, you may also be able to get a free ADT security system, along with a discounted rate on professional monitoring. Openly is currently available only through independent agents, with no option to get an online quote. We combed through all of our 4.5-star companies to find the ones that took top honors on various aspects of our rating system, such as coverage and consumer complaints.

To determine the top insurers for each category, NerdWallet compared rates among companies for which we had data in at least 15 states. Just because an insurer is affordable for one set of circumstances doesn’t mean that company will always be the best option. NerdWallet looked at how different factors have an impact on the cheapest home insurance rates available. DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. The coverage options available to you will depend on which insurer you choose. You may be able to add coverage for water and sump pump backup, or for personal injury liability, which can defend you from charges like slander and libel.

Ask your agent to give you a rate estimate for a house you’re considering. California, Maryland and Massachusetts don’t allow home insurance companies to use credit as a factor in rates. By avoiding them when possible you can get cheaper home insurance rates. For example, some home insurers have a “trampoline surcharge” to account for the increased risk of insurance claims. Ask your insurance agent how much you can save if you increase your home insurance deductible.

No comments:

Post a Comment